The European Anti-Fraud Office (OLAF) - Mandate, Facts and Figures

The European Anti-Fraud Office (OLAF, abbreviation for Office Européen de Lutte Anti-Fraude) is an office established by the European Commission. It is currently attached to the Commissioner for Taxation and Customs Union. However, OLAF is completely independent in the way it exercises its investigative mandate. The current head of OLAF is Director General Ville Itälä. The organisation is divided into four directorates.

Organisation

Directorate A – Expenditure – Operations and Investigations

Directorate A deals with internal investigations, inquiries and procedures concerning direct expenditure and those under shared management.

Directorate B – Revenue and International Operations – Investigations and Strategy

Directorate B develops the customs, trade and tobacco anti-fraud strategy. It is also responsible for national and international investigations and proceedings concerning health and the environment, customs and trade.

Directorate C – Anti-Fraud Knowlegde Center

Directorate C deals with the fight against corruption, anti-fraud strategy and analysis, intelligence and process analysis, as well as digital strategy and forensics.

Directorate D – General Affairs

Directorate D is responsible for legislation and the anti-fraud program, legal advice, finance and compliance, procurement and security.

Mandate

OLAF can act in cases of fraud, corruption and other criminal offences affecting the EU’s financial interests. These interests include all EU expenditure, certain areas of revenue (in particular customs duties) and suspected cases of serious misconduct by staff and members of the EU institutions and bodies. As part of this mandate, OLAF carries out independent investigations to ensure that all EU taxpayers’ contributions are used to promote economic growth in Europe. Where appropriate it works in cooperation with national criminal and administrative investigative authorities and international bodies. OLAF distinguishes between internal and external investigations.

Internal investigations are investigations within the EU institutions and bodies with the aim to detect fraud, corruption or any other criminal offence affecting the EU’s financial interests, including serious breaches of duty by EU officials.

External investigations are those conducted outside the EU institutions and bodies in order to detect fraud or any other illegal activity by natural or legal persons.

After the conclusion of an investigation, OLAF makes recommendations to the EU institutions and national governments regarding legal, financial, disciplinary and administrative measures. Subsequently, it monitors the implementation of these measures. This has the aim to evaluate the impact of OLAF’s anti-fraud activities and to adapt the assistance offered by OLAF to the needs of the national authorities.

In addition to its own investigative activities, OLAF coordinates wide-ranging joint customs operations involving the EU and international partners. These are targeted operations of limited duration with the aim to combat fraud and the smuggling of sensitive goods in risk areas and along certain trade routes. In 2018, OLAF has coordinated five joint customs operations. One of them was the Joint Action Hansa which focused on the internal movement of illegal excisable goods (mainly cigarettes). The action resulted in the seizure of 41 million cigarettes and 11.5 tonnes of raw tobacco.

Furthermore, OLAF plays an active role in the development of anti-fraud policies and assists in the drafting and negotiation of legislation to protect the EU’s financial interests against fraud and corruption.

Facts and Figures

Between 2010 and 2018, OLAF conducted more than 1,900 investigations, recommending the recovery of more than 6.9 billion euro in favour of the EU budget. In addition, OLAF issued more than 2,500 recommendations which call for action by the competent authorities of the Member States and the EU. In 2018 alone OLAF opened 219 new investigations, concluded 167 investigations and issued 256 recommendations. The latter included measures to recover 376 million euro in favour of the EU budget. The annual report for 2019 is still pending, but it is expected that the number of investigations will be of a similar scope.

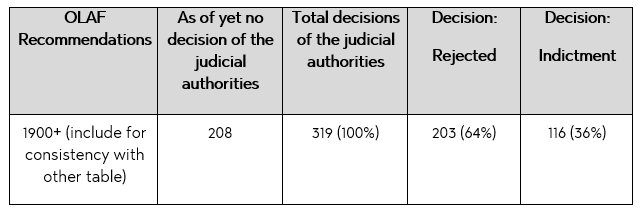

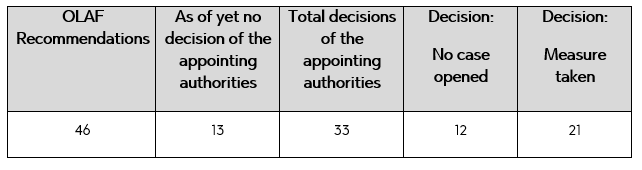

Of the judicial actions undertaken by member States’ authorities as a result of OLAF recommendation, 36 % of all cases between 2012 and 2018 led to formal charges (see Table 1). In addition, out of 46 recommendations by OLAF between 2016 and 2018, 21 of these led to disciplinary measures by the respective appointing authorities at EU institutional level (see Table 2).

Table 1: Measures taken by national judicial authorities of EU Member States following OLAF recommendations between 2012 and 2018

Table 2: Disciplinary measures taken by EU appointing authorities following OLAF recommendations between 2016 and 2018

The data shows that OLAF not only plays an essential role in the fight against fraud at EU level, but also that its recommendations have a significant impact on the prosecution of fraud by the competent national authorities. It is for this reason that companies operating across borders should be aware of OLAF’s impact. If you are about to face an OLAF investigation or if an investigation it is already ongoing, it is indispensable to know what legal instruments are at your disposal during OLAF investigations. In the coming weeks, BLOMSTEIN will publish client briefings on this subject, which are intended to serve as initial guidelines for companies operating across borders which are facing (the threat of) an OLAF investigation.

BLOMSTEIN advises you on all matters relating to OLAF investigations and compliance. Roland M. Stein and Laura Louca will be pleased to assist you at any time.